|

||

|

|

Join

The Miami Herald's Business Monday Book Club.

Click here for information.

Music Reviews and Features

Dion Dimucci

Lester Bangs in "Almost Famous"

History of Warner Brothers Music

Food & Dining

Creolina's

Cajun/Creole

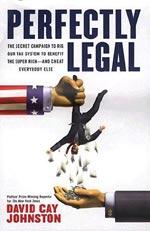

Perfectly

Legal: The Covert Campaign to Rig Our Tax System to Benefit the

Super Rich -- and Cheat Everybody Else. David Cay Johnston. Portfolio.

352 pages.

|

|

BY

RICHARD PACHTER

rpachter@wordsonwords.com

Originally published on Monday, January 26, 2004 in The Miami Herald.

Don't read this book. It will make your blood boil. If you labor

under the illusion that the tax system of the United States is basically

fair, you will be disabused of this notion quickly. And if you are

a Democrat and believe that the current Republican regime initiated

the wildly lopsided advantages big business has over other taxpayers,

you'll be unpleasantly surprised to discover that the Grand Old

Party does not enjoy an exclusive franchise in this area.

IN-DEPTH REPORTING

New York Times reporter David Cay Johnston has put together a truly

mind-boggling volume that illustrates, in plain and mostly unemotional

language, how special interests -- in this case, the super rich

-- take advantage of existing loopholes and create new ones, as

needed, in the U.S. tax code. With the collusion of corrupt lawmakers

and an largely apathetic public that's hostile to tax collection,

in general, and the Internal Revenue Service, in particular, canny

accountants have crafted arcane tax shelters that hide income that

most reasonable people would have assumed would be subject to taxes.

Johnston writes: ''In 1977, the richest 1 percent of Americans had as much to spend after taxes as the bottom 49 million. Just 22 years later, in 1999, the richest 1 percent -- about 2.7 million people -- had as much as the bottom 100 million Americans. Few figures derived from the official government data on incomes present more starkly the growing chasm between the rising incomes at the top and the falling incomes at the bottom. Those in the top 1 percent saw their average income, adjusted for inflation to 1999 dollars and after income taxes were paid, more than double from $234,700 in 1977 to $515,600 in 1999. Meanwhile, the 55 million Americans in the poorest fifth of the population lived in households whose average income fell from $10,000 in 1977 to $8,800 in 1999.

''Across the political spectrum, economists found the same basic trend: the rich really are getting richer and the poor really are getting poorer. Between 1973 and 2001, those whose income ranked them above 80 percent of Americans but below the richest 5 percent -- those on the 80th up to the 95th rungs -- saw their share of national income rise almost imperceptibly. The Bureau of the Census calculated that in 2001 they earned 27.7 percent of all income, up from 27 percent in 1973. The top 5 percent did much better. Their share of the national income grew by more than a third, from 16.6 percent to 22.4 percent. There is the suggestion of a pattern here, of those at the top of the ladder having so much added income that it is reinforcing their position, holding the middle class in place and squeezing those at the bottom, whose incomes were falling.''

SHIFTING BURDEN

Playing with Social Security and the Alternative Minimum Tax, crafty

accountants for the rich are shifting the tax burden to those least

able to afford it, giving ''trickle-down economics'' a whole new

meaning.

Johnston is a bit long-winded at times, and the experience of reading

this book is hardly a pleasant one, but if you'd like to know how

the tax system has been subverted, you need to read this book.

©2004 Words on Words, All rights reserved.